Inlaks, one of Africa’s oldest tech companies, has launched a new tech hub in Nigeria – theHatch. Called theHatch, the hub is focused on the fintech sector. theHatch will mentor the next wave of entrepreneurs developing homegrown financial services and solutions, particularly for the insurance industry. The hub will also provide funding and help innovators hit the ground running with their disruptive ideas.

Meanwhile, Inlaks’ decision to launch a new tech hub is, frankly, somewhat puzzling.

Nigeria already has quite a few tech hubs. According to a report by the GSM Association (GSMA), there are already 55 tech hubs in the country, 31 of which are based in Lagos.

So what will value does Inlaks’ theHatch hub add to the ecosystem?

Inlaks Joins the Niche Train in the Ecosystem

Importantly, Inlaks’ new tech hub takes a different approach in the startup ecosystem. As a fintech-focused hub, theHatch is a niche tech hub. And according to GSMA, niche tech hubs are a new trend in the development of tech hubs in Nigeria.

Inlaks CEO, Femi Adeoti. Source: Nigeria Communications Week

Many new tech hubs today are increasingly specialised and tend to focus on developing startups to address particular markets, industries or sectors. Inlaks’ latest tech hub only fuels this trend even further. This focus makes the new hub more appealing to entrepreneurs, and suggests the incubator could help get them to market quicker.

Now the belief, although this is unproven, is that niche tech hubs help to develop innovative products much quicker than regular tech hubs. Many niche tech hubs are founded by companies or institutions with significant strength or presence in certain markets. The idea is that they can use their existing strength in a particular sector to accelerate growth of the companies within their hubs.

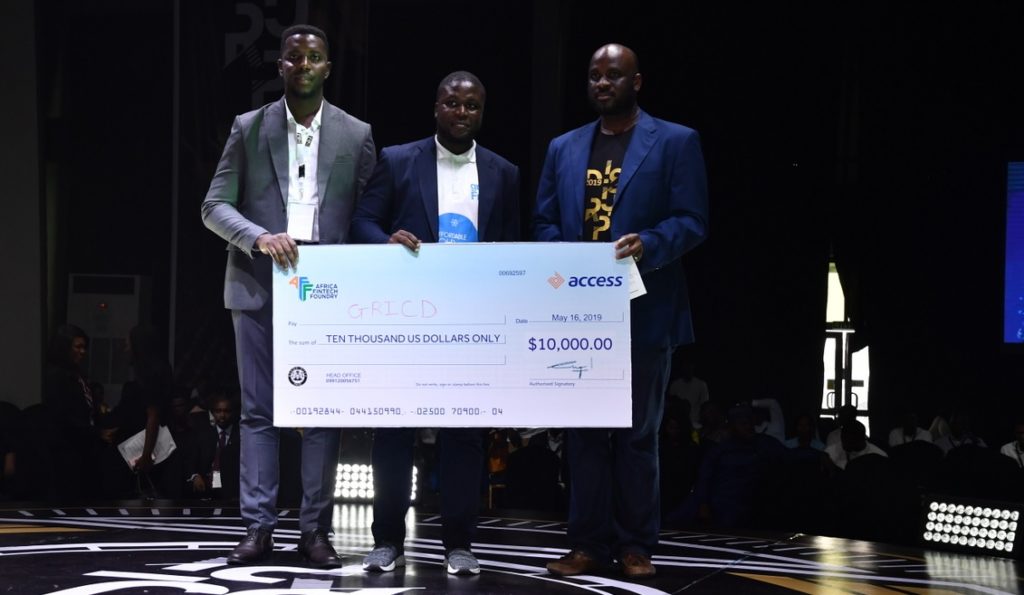

Representatives of the African Fintech Foundry (AFF) present a $10,000 check to the winner of its 2019 Startup Challenge. AFF is one niche tech hub supporting fintechs in the ecosystem, and is owned by none other than Access Bank. Image Source: Accelerate TV

For instance, the African Fintech Foundry is a fintech tech hub created by Access Bank. Meanwhile Blue Labs also specialises in moulding fintech startups and is owned by Stanbic IBTC. The Global Edtech Startup Award (GESA), which supports startups developing educational products , was initiated by MindCET, an Israeli edtech company. Another example is the GSMA accelerator program, initiated by the GSM Association, the tech hub targets startups developing mobile services. With the resources, institutional and network support of their initiators, these hubs equip cohorts with a great deal of product development support, networking and access to proprietary industry tools.

So that’s a plausible explanation for why Inlaks launched its own niche tech hub. And with its focus on fintechs, Inlaks will definitely attract a lot of attention from both the media and investors.

However, while the appeal inherent in niche hubs is great, there are a few things newer tech hubs can do to become even more valuable.

How Niche Hubs Can Add More Value to the Ecosystem

Now the most important of these is to address diversity issues when selecting what startups to focus on. For now, most niche hubs target fintech startups; Inlaks just added to number. It’s understandable why they do: fintechs have the most obvious investment benefits. Yet this over-concentration on fintechs may lead to a saturated financial market, with cohorts from different tech hubs all developing similar products.

A few new incubators and accelerator programs are already shifting from this trend. For instance, Itanna, a hub founded by the Honeywell Group, differentiates itself from the other hubs with a focus on businesses that are complementary to its parent company, Honeywell’s business. The food, manufacturing and distribution focus mean that it offers value to a different segment of the tech ecosystem and Nigerian economy than the roster of fintech focused hubs.

Diversity along the value chain is also critical. The many startups and hubs focused on the same payment and investment products miss the opportunity to service other critical parts of the financial technology chain. As with many sectors of the Nigerian economy, copying other people’s ideas eventually leads to stagnation and stunted growth. To be clear, copying an idea is not necessarily a bad thing; but it sometimes leads to complacency on the part of would-be innovators. There simply must be more strategic intents from the ground up.

Yaba is dubbed the Silicon Valley of Nigeria. But it has been losing this status slowly as infrastructural dearth forces companies to move. Source: Quartz

Diversity also extend to investing in startups in different domains. Sometimes, hubs can identify investment opportunities within their community. This is one route recommended by VC firm, Village Capital. Amongst its recommendations to investors last year, the firm suggested investors (hubs included) commit funds to “place based assets”, ranging from public utilities, real estate to other ventures. This interesting approach will increase the number of companies and startups eligible for investment. One instance where this idea seems valuable is in the thriving tech environment of Yaba.

Already the home of a few tech hubs and startups, Yaba could benefit from community based investing if attention is focused on issues ranging from traffic control, waste management, housing and even health care. Notably too, absence of proper infrastructure has been a key reason why many analyst now question the importance of Yaba to tech innovation in Nigeria. Meanwhile, if community based investing is utilised by tech hubs, it could help address critical questions, while serving as a use case for new innovative products. In the long run, this will also help address the diversity issues that continues to tilt most niche hubs towards fintechs.

These suggestions may run contrary to the hype and trends in the startup ecosystem. But Inlaks’ new hub bolsters the niche fintech trend. But going forward, newer tech hubs and the ecosystem might want to pay attention to diversity and non-fintech opportunities around them.