The bike hailing business has gained a lot of traction in Nigeria this year. Particularly, in the last few months, news about the increasing number of bikers, funding rounds and new market entrants have emerged; suggesting the bike hailing market is attracting a lot of interest. While existing players like MAX and Gokada raised important funding, newer players like SafeBoda and ORide have emerged, backed by their own deep pocket financiers.

But despite all these positive news, startups in the bike hailing market have unaddressed regulatory issues in Lagos, Nigeria’s most populous city. As a result of unrevised traffic laws in the state, bike hailing startups are vulnerable to certain offenses that could affect their operations in the future.

Motorbike Regulations in Lagos

Lagos is the biggest market for bike hailing in Nigeria. With its over 20 million residents, Lagos is the first market of choice for all bike hailing startups in Nigeria. Yet, Lagos is one Nigerian state that has imposed tight controls over motorcycle transportation.

In 2012, the Lagos state government imposed harsh bans on motorcycle movements in the state. Due to worries caused by frequent motorbike accidents, the government barred motorbikes with less than 200 cylinder capacity (CC) from operating on 475 routes in the state. This ban effectively affected most commercial okada riders operating in the state since many of them used bikes with less than 200 CC capacities.

Motorbikes (okadas) are banned from operating in over 500 roads in Lagos State. Source: Technext

In 2017, the government again stepped up this restriction. It further restricted these motorbikes from a total of 520 roads.

Now, when you consider the dates of the above government actions, it’s clear, these moves predated the current bike hailing market. The market as we know it only began gathering shape in 2018.

However, despite this, the government has not relaxed any of the bans it previously introduced.

But when bike hailing startups emerged, companies like Metro Africa Xpress (MAX) and Gokada resorted to meet some of these laws while taking different precautions to bypass the others. For instance, rather than use any kind of bike, these startups mandate that all riders use bikes with cylinder capacity of 200 CC or more. They also developed a loan scheme for bikers. These startups provide their riders with 200 CC bikes upfront while bikers pay for the bike in installments.

Motorbikes (okadas) are blamed for causing many accidents on the road. Image source: Nairaland

Bike riders were, and are, still provided with safety, road usage and customer relations trainings. According to ORide, the most recently launched bike hailing service in Nigeria, these are some ways it is addressing safety and other concerns associated with motorcycle transportation.

But despite all these initiatives, tight bike regulations still exist. Bike hailing startups were reminded of this harsh reality earlier this year.

Bike Hailing Startups an “Eye Sore”?

In March, 22 Gokada and MAX bikes were impounded by the Lagos State Task Force on Environmental Sanitation and Special Offenses. A statement from that time claimed bikers working with these startups had violated state road traffic laws.

According to Oluwatosin Omojuyigbe of the Punch, these bikes were operating on “restricted routes” and drove against traffic in locations like Maryland, Ojota and Ikeja. Although the latter issue is a punishable offense regardless of prior motorbike bans, a statement from the chairman of the taskforce revealed something much deeper.

In March 2019, bikes affiliated with MAX and Gokada were impounded by the Lagos State task Force.

Olayinka Egbeyemi, chairman of the task force called ride hailing startups an “eye sore”. “It was an eyesore seeing the operators of these newly-branded commercial motorcycles, ‘Gokada’ and ‘Maxokada’, in competition for the right of way with motorists on highways and bridges across the state,” he said.

He asked passengers not to use “commercial motorcycles” on any restricted route in the city. If caught, both the bikers and their passengers would be prosecuted, he warned. Coming from a high ranking official, these comments are a rebuke of bike hailing startups.

Nevertheless, the arrests and warning to startups did reveal the regulatory gap present in the bike hailing market.

Recently, the new governor of Lagos, Babajide Sanwo-Olu, signaled his intention to take traffic offense more seriously. On June 14, the governor visited the office Lagos State Traffic Management Authority (LASTMA) in Oshodi. During the visit, the governor reiterated that Lagos has not relaxed laws banning commercial motorbikes on major roads. “There are rules that guide operation of commercial motorcycles,” he said. “The Lagos State law has stated that okada should not operate on some roads”, he added.

Lagos State Governor, Babajide Sanwo-Olu has indicated he will take traffic offenses seriously. Image source: Nigeria World

The Governor also promised financial and other improvements for LASTMA, and asked them to step up enforcement of traffic laws in the state. Following his visit, LASTMA tweeted a list of 64 traffic offenses in the state and the penalties they carry. The list repeated that bikes with less than 200 CC engine capacity will be impounded if caught operating as passenger transportation.

But the list also re-emphasized that “driving in a direction prohibited by the law/neglect of traffic direction” is an offense. This is an ambiguous traffic offense that means bikes affiliated with bike haling startups are still vulnerable to existing bans on bikes on certain routes. Penalty for violating this law is “forfeiture of vehicle to the state”, with a possible prison sentence ranging from 1 – 3 years jail term.

These issues further capture the regulatory grey area bike hailing startups are operating in.

Bike Hailing Startups Admit Regulatory Concerns Exist

Meanwhile, bike hailing startups are not dismissing this claim.

On their own parts, bike hailing startups in Nigeria are not making loud or vocal statements about the regulatory issues in the business. But that does not mean they are denying that these issues exist.

ORide launched in Lagos recently. Image source: Weetracker

For example, ORide, the Opera-backed bike hailing startup, admitted that regulatory issues are currently affecting its operations in the state. “There are regulatory challenges with bike-hailing at the moment in Lagos”, said the ORide Country Manager, Iniabasi Akpan.

In an exclusive statement sent to TechCabal, Mr Akpan reveals that only motorbikes used for dispatch and delivery are allowed to operate on major highways; while commercial bikes for passenger transportation are not allowed. This is interesting, especially when you consider that ORide has only been in the market for one month.

Babajide Duroshola, Country Manager of SafeBoda also admitted that regulations do exist. “Well, it is what it is!” he wrote. “The government [of Lagos] has 475 roads that okada’s (motorbikes) are banned from”.

Regulatory Concerns Stopping UberBoda’s Expansion into Nigeria

But the regulatory grey area is not just affecting startups already operating in the bike hailing market. Uber, the ride hailing company, says this regulatory grey areas in Lagos is the main reason why it hasn’t launched UberBoda, its own bike hailing service, in Nigeria. Meanwhile, the service is currently available in countries like Kenya and Uganda.

UberBoda launched in East Africa last year, but it is holding back from expanding to Nigeria due to regulatory worries. Image source: Uber.

Speaking on the sideline after the recent Uber Townhall event held on Thursday, June 27, Justin Spratt, Head of Business Development for the Middle East and Africa at Uber, disclosed that UberBoda wants to launch in Nigeria. But he conceded that the regulatory grey area is something they want to address first.

He admits that there are two areas of concern presently. The first concern is that, by law, commercial bikes carrying passengers are banned from hundreds of roads in Lagos. And the second area of concern is the requirement that all commercial bikes must be 200 CC or more to operate on these roads. So unlike Kenya and Uganda, Uber would either have to buy 200 CC bikes of its own or get bikers who own such in order to operate in Lagos. Meanwhile, 200 CC bikes are only just emerging for passenger transportation after the Lagos government banned bikes with less capacity. Many bike hailing startups in Lagos provided 200 CC bikes to riders through a hire purchase scheme, with riders making daily repayments.

When asked why Uber isn’t doing what other startups are doing by simply entering the market while awaiting regulatory repositioning, Mr Justin says “Uber is no longer a startup”. He explained that few years ago Uber could do such, but today they want things to be done “more elaborately”. “We want to be regulated”, adds Brooks Entwistle, Uber’s Global Head of Business Development, “because regulation promotes servitude.”

What are Startups Doing about Government Regulations?

So from the foregoing, it is obvious that bike hailing startups in Lagos are operating in a grey area. This makes them quite vulnerable to unpredictable government regulations; an issue that could affect them, if unresolved, in the long run.

Yet despite this, these startups are still raising bigger funding rounds, attracting more riders and gaining steady patronage. But in order to keep this momentum going, what are these startups doing to about government regulations?

All four bike hailing startups in Nigeria are currently making efforts to settle the regulatory question mark over their business.

An important way they are addressing this matter has been to hire individuals who will lead engagements with the government. For example, in late May 2019, Gokada appointed Kayode Adegbola as Director of Regulatory and Government Affairs. Now, Mr Kayode has some links with the Lagos State government. Before his appointment, he was an executive assistant to the CEO of the Lagos State Employment Trust Fund (LSETF), a fund created to help create jobs in the state. He also previously contested the Ogun State House of Assemblies under the All Progressives Congress (APC), the political party which rules Lagos State.

Bike hailing startups use bikes with 200 CC capacity and above, but the state has restricted them from using certain roads.

Soon after his appointment, OPay (which operates ORide) brought in Modupe Durosinmi-Etti to the position of Government and Policy Manager. Ms Durosinmi-Etti will lead engagements with the government and could handle regulatory negotiations.

Gokada’s choice of Mr Kayode and OPay’s appointment of Ms Durosinmi-Etti showed that bike hailing startups were ready to make a stronger push to address the regulatory problems.

Gokada paid a courtesy visit to Ondo State Governor @RotimiAkeredolu. 01/07/19 pic.twitter.com/towcXsAwHt

— 'Kayode Adegbola (@kayodea) July 1, 2019

Gokada for instance has started courting government attention through different forms of engagements. Last week, the startup signed an agreement with the Lagos State Parks and Gardens Agency (LASPARK) to plant 100,000 trees across the state within the next five years. Gokada has also made courtesy visits to the governors of Ondo and Ekiti States. These moves help to improve brand awareness in the political circle and could boost any regulatory discussion in the future.

Meanwhile, SafeBoda’s Babajide Duroshola said “all stakeholders need to come together” now to provide a fix for the regulatory concerns.

In a chat with TechCabal, Mr Kayode of Gokada made a similar statement. “We are engaging government stakeholders in order to address concerns around safety, security, and quality of service with regulation, and we are optimistic,” he said.

Iniabasi Akpan of ORide also adds that no formal agreement has been reached with government so far. “But there are hopeful signs”, he said.

What Happens Now?

So it is clear now: bike hailing startups have regulatory issues that need to be fixed. But each startup in the market is making some efforts to address the issue one way or the other. But no agreement has been reached and there is no clear path to one presently.

However, this does not mean bikers operating with these companies will or do face harassment similar to regular okada riders. A Lagos State Task Force operative in Oshodi who spoke anonymously disclosed that bike hailing startups have little to worry about. “As long as they don’t use one-way, they don’t carry two passengers and their bikes are 200 CCs, there’s no problem.” Such statement captures the grey area these startups currently operate in.

But bike hailing startups and their investors would prefer a more elaborate approach to their operation. The goal would be to convince the government to relax regulations on motorbikes, or to get the government to develop a new transportation regulatory framework that accommodates bike hailing startups.

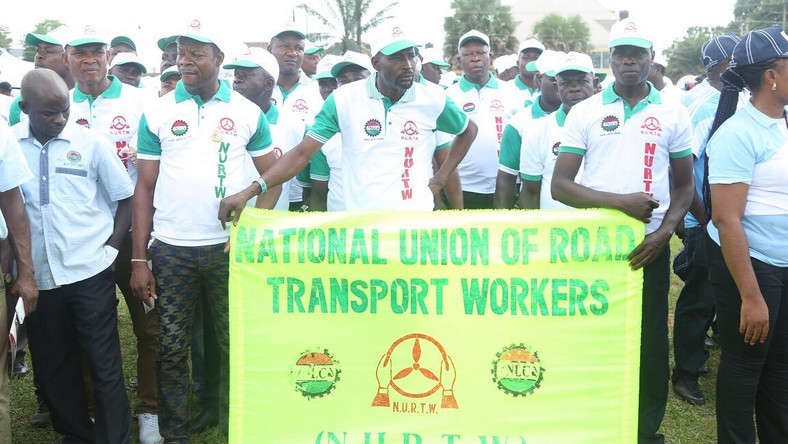

On the one hand, simply relaxing regulations on motorbikes generally could lead to the return of regular okadas, many of whom are fond of breaking the law in order to operate. On the other hand, revising passenger transport regulations to allow only bikes from startups to operate could spark a debate and possible conflict between the government, bike hailing startups and the National Union of Road Transport Workers (NURTW), Nigeria’s largest trade union that covers okada riders.

The National Union of Road Transport Workers (NURTW) is the largest trade body for transport workers in Nigeria

So far, there have been no debates or conflicts between bike hailing startups and the NURTW, at least none has been reported. One possible explanation for this could be that existing traffic laws in Lagos ban bikes affiliated with either transport startups or NURTW. As a result, the trade union may see little difference between its riders and those affiliated with transport startups. In reality too, bikes affiliated with either group are frequently seen violating similar traffic laws, like using BRT lanes or using one-ways. As a result, mutual suspicion has not brewed between either groups, at least none has been reported so far.

But as bike hailing startups try to make themselves more credible and legitimate to secure government regulatory support, the distinction between their bikes and those of NURTW will become more obvious.

In light of these, a more probable solution would be to develop a road transportation framework in partnership with all stakeholders. Such framework would accommodate both transport startups and the transport unions, as well guarantee the safety measures the government seeks to enforce. A lot of compromises would be needed in order to arrive at this framework though, and it could take a long time before an agreement is reached.

However in the meantime, bike hailing startups will continue to operate in the regulatory grey area and will hope the government doesn’t enforce all motorbike regulations any time soon. We should watch this business closely.