Nigeria-based OPay has closed a new $50 million funding round, the largest for any Nigerian tech startup so far in 2019. The company will use the new funding to deepen its roots in the Nigerian market for all its digital businesses including ORide and OFood. It also has plans to expand to other African markets.

Created by the Norwegian software company Opera, OPay emerged in 2018 following Opera’s acquisition of PayCom, a Nigerian fintech service owned by Telnet Nigeria. Following its launch, OPay had access to Opera’s $40 million investment fund for Nigeria.

However, the latest funding round saw some of China’s biggest startup funders investing. They include Sequoia Capital, IDG Capital, Source Code, GSR Ventures and Meituan-Dianping. Opera itself also invested in the round.

The interest of these companies in the Nigeria-based OPay is thanks to Opera’s recent re-emergence as a Chinese-owned company. The company was acquired by a consortium of Chinese investors for $600 million three years ago.

Source Code Capital, a recent OPay investor, spotted and invested in Bytedance, the startup which owns the social media app, TikTok.

However, the entry of these investors is an interesting development for OPay. Beyond the large amount raised, these investors have a history of backing innovative companies that go on to become quite valuable and successful in the long run. For instance, Source Code Capital has backed over 150 startups operating in China. Some of these include ByteDance, the company behind the popular TikTok video app; and Mogu, a 10-year old fashion tech company valued at $1.3 billion when it listed on the Nasdaq in 2018.

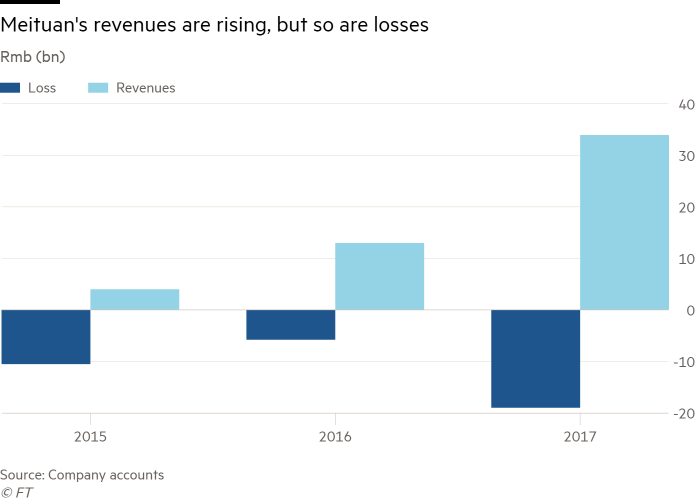

IDG Capital and Sequoia Capital have invested in Chinese companies like Tencent and Alibaba. Image source: Financial Times

IDG Capital has also backed many successful startups across Asia, some notable mentions include Baidu, Tencent and Xiaomi.

Sequoia Capital China has equally recorded notable investments some of which include startups-turned-behemoths like JD.com, Didi Chuxing and Alibaba.

Another interesting investor backing OPay from the recent funding round is Meituan Dianping. As one of the world’s largest on-demand delivery services, Meituan Dianping has been described as the world’s most innovative company. Importantly, the company developed a super app with a major focus on food delivery, a market segment OPay looks to tap into with the creation of OFood. OPay could benefit from Meituan Dianping’s success and expertise in these areas going forward.

Together, these Chinese companies have the experience, finances and network that is required to turn OPay into a dominant player in the Nigerian ecosystem. For instance, Sequoia Capital is an investor in Didi Chuxing, the ride hailing startup in China which lost over $1 billion in 2018. This shows that the investor is ready to back companies with great potentials (Didi is worth $56 billion) despite the burn rate that they may incur. Another recent OPay investor, Meituan Dianping provides another positive for the Nigeria-based company.

Meituan Dianping is a recent OPay investor and it is also one of China’s biggest companies, but it is burning cash fast as it competes with behemoths like Alibaba. Image source: Financial Times

The Chinese company has developed a super app to provide a host of services for users including food delivery, ride hailing, hotel booking and payments. OPay is on the path to develop a similar super app and already offers payment services on its app alongside ride hailing and food delivery. Now its affiliation with China’s Meituan Dianping could afford it with the expertise and insights needed to develop a powerful super app in the long run for the Nigerian and African markets. Meituan Dianping which faces fierce competition from bigger companies like Alibaba and Tencent which runs WeChat, could want OPay to develop a superapp much earlier in order to fend off competition.

OPay Seeks Quick Growth in Nigeria and Africa

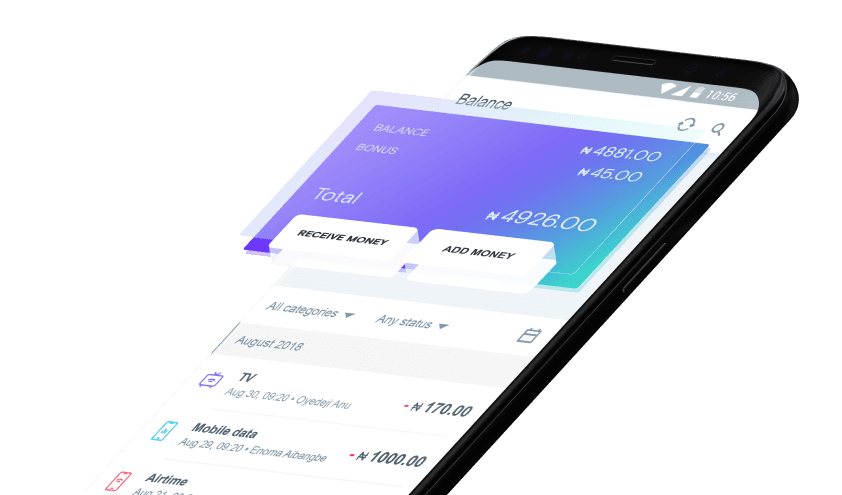

Meanwhile, on its own part, OPay has recorded impressive growth since it emerged 18 months ago. OPay launched as a mobile money solution following Opera’s PayCom acquisition in May 2018 for an undisclosed fee.

Since then, the startup has been a crucial piece of Opera’s plans to improve financial inclusion in Africa and tap into the continent’s digital economy.

OPay is a super app with a few services like payments, food delivery and bike hailing.

As a mobile money company, OPay has grown quickly since 2018. The company has doubled its agent network each month since April 2019 growing from 10,000 in April to 20,000 agents in May. The company now has over 40,000 active agents according to a recent press release.

OPay is also gradually developing features that could transform it into a challenger bank. It already allows users use their phone numbers as their bank accounts to receive and send money. Now it plans to introduce ATM cards to allow users make online transactions and withdraw cash.

That is a big goal for the young company.

Additionally, OPay has since developed new verticals in the food delivery and the transportation industries.

ORide is OPay’s bike hailing service

In May 2019, the company launched ORide, its own bike sharing service to rival Gokada and MAX in Lagos, Nigeria. ORide has equally gained traction quickly based on the optics so far. It has since expanded operations to Ibadan, one of Nigeria’s most populous cities.

OFood, OPay’s food delivery business, is still in beta, but is available for use by people in Lagos.

Scaling and developing these services could see OPay burn through cash at a high rate. The new funding round is a testament to this. Even though it has access to Opera’s $40 million fund to invest in Nigeria, OPay has pursued external financing to strengthen itself.

Meanwhile, the startup’s mobile money and bike hailing competitors in Nigeria have not raised such high amount of consistent equity funding. In perspective, Paga has raised $34.7 million since it launched 10 years ago, while Carbon (Paylater) has raised $5 million. MAX and Gokada in the bike hailing business have secured $9 million and $5.3 million respectively so far.

So, judging by the optics, OPay looks poised for growth now. Its new round of funding and the reputation of its investors, capture the potentials of the young company.